This post is updated in July 2014 since there are now 2 ways(tools) by which you can file income tax. The first i shall capture the Java Utility step the second one is the one I had capture in 2013.

File tax using Java Utility

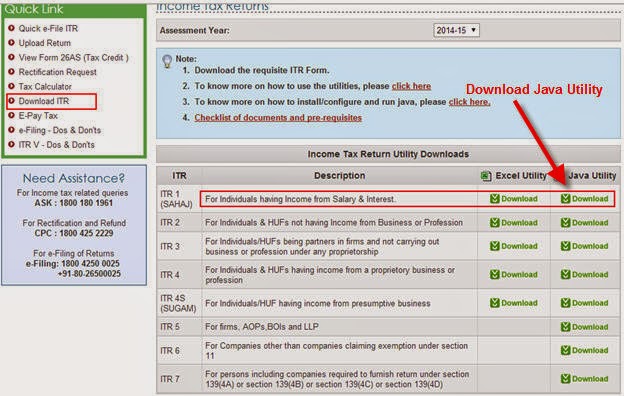

Step 1. Download the Utility as below

then you can unzip the utility in the same folder the files will show as below.

Done !!

Below is a step by step help(9 simple steps ) for e filing of income tax for individual tax payers (salaried) Using the Excel Utility. Please follow the steps below (do feed back your comments on the post)

.

File tax using Java Utility

Step 1. Download the Utility as below

Step 2 Unzip the Java Utility

Assuming that you have downloaded the Utility to the folder C:\Taxthen you can unzip the utility in the same folder the files will show as below.

Step 3: Run the Java Utility

Assuming You have downloaded in the folder C:\Tax then open a comman prompt by typing 'start' -> Run -> cmd as below

In the command window give command to reach the tax folder type cd c:\tax

Now Run the ITR.bat file by just typing ITR and press enter this will run the ITR java Utility.

Open the ulitity and follow the steps as below

Select Pre

Per fill to prefill values from previous year data.

Below is a step by step help(9 simple steps ) for e filing of income tax for individual tax payers (salaried) Using the Excel Utility. Please follow the steps below (do feed back your comments on the post)

- Go to the e filing site https://incometaxindiaefiling.gov.in/ , first step is to register yourself.

2. Select 'Individual' as below.

3. Fill in your PAN number, Surname and Name (as it appears in the PAN card), provide your email ID and mobile number

After registration you will be sent a verification mail to your mail ID. click on the link and verify.

Now login with the new account ID (Remember login ID is the PAN number and also you need to give 'Date of Incorporation (Date of birth dd/mm/YYYY)

4. Download the ITR excel sheet by clicking the link as below.

This will download a zip containing the Excel. Fill in the 3 sheets as below.

Fill each of the 3 sheets, i.e. ‘Income Details ‘ , ‘TDS ‘, ‘Taxes paid and Verification ‘ (if exemption for donation then u can fill in the 4th sheet ‘80G’), after filling each sheet click on Validate button to see things are ok.

to see things are ok.

to see things are ok.

to see things are ok.

All data can be obtained from Form 16. Fill in the mandatory fields as below

‘ button in the 1st sheet (‘Income Details) check if the tax is same as the Form 16 (it should be thesame).

6.Now generate the xml by clicking the button  this will generate the xml. The excel sheet opens with a ‘Save’ button this will actually save the xml in the same folder where the ITR1 excel exists

this will generate the xml. The excel sheet opens with a ‘Save’ button this will actually save the xml in the same folder where the ITR1 excel exists

this will generate the xml. The excel sheet opens with a ‘Save’ button this will actually save the xml in the same folder where the ITR1 excel exists

this will generate the xml. The excel sheet opens with a ‘Save’ button this will actually save the xml in the same folder where the ITR1 excel exists

7.Now upload this XML to the site clicking the link as below. Select ‘ITR-1’ and assessment year (the year as in the form 16) and browse to the xml location then click ‘Submit’.

Note : On Upload if invalid country code comes up you can change it

in the XML it should be 91 (this is only for those who get this error, if no error then please ignore )

8.Save and upload. You get a confirmation and a link to

download the ITRV download it by clicking the link. The password for itrv is pan+DOB

9. Do not forget to Sign and send a copy to CPC address mentioned in the ITRV.